IN FOCUS | 33 IMAGES

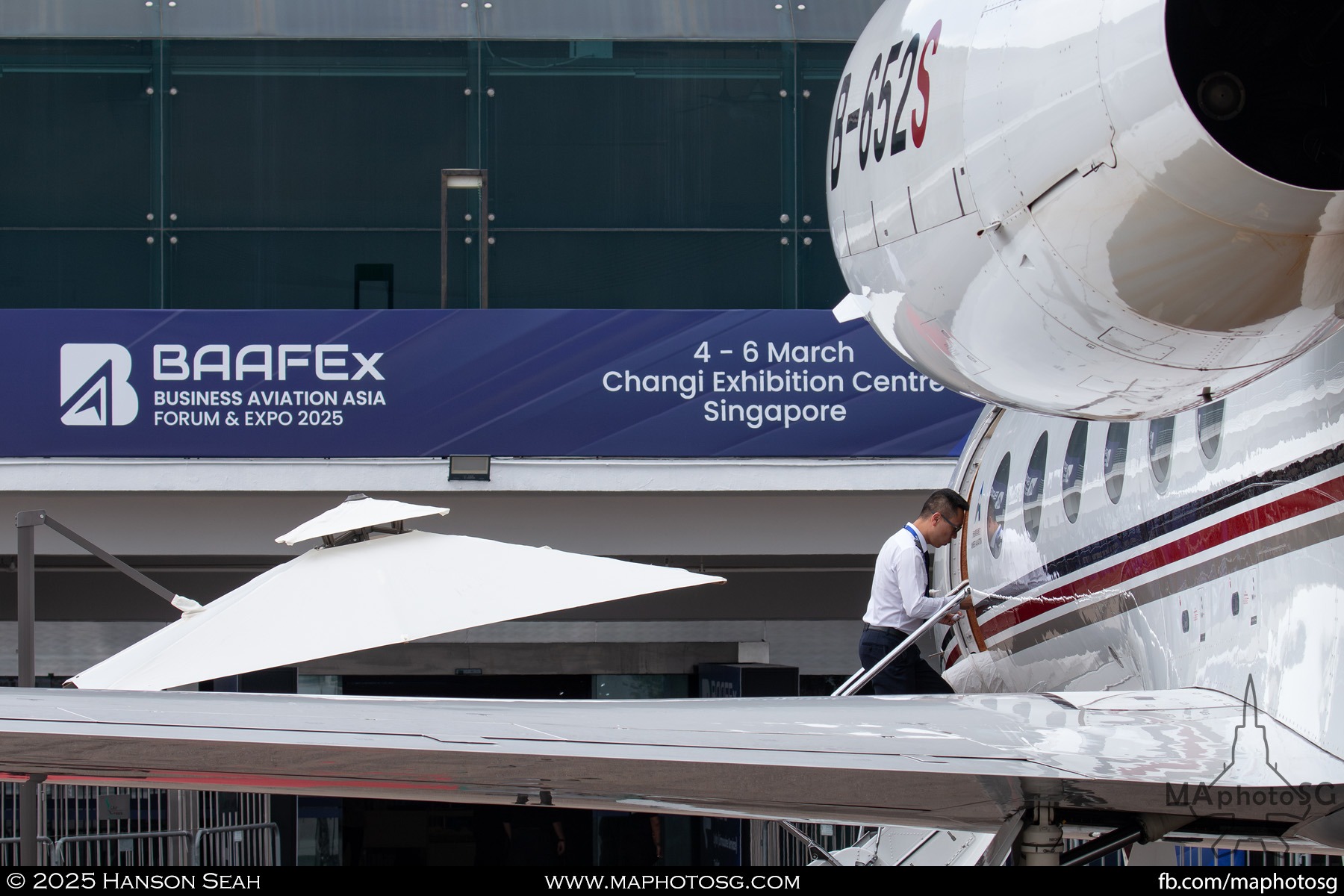

The inaugural Business Aviation Asia Forum & Expo (BAAFEx) was held from March 4 to 6, 2025, at Changi Exhibition Centre (CEC), Singapore. This event marked a significant milestone in the business aviation sector, providing a dedicated platform for industry professionals to connect, showcase innovations, and discuss emerging trends within the Asia-Pacific region. BAAFEx was conceived to fill a notable gap in the region’s aviation event calendar, offering a biennial gathering that alternates with—and most importantly, differentiates itself from—the Singapore Airshow.

The show was dubbed a resounding success, with higher traffic than expected, exceeding 2,000 attendees from 56 countries. There were 31 exhibitors, three static display aircraft and 12 conference sessions featuring 46 expert speakers, presenting a dynamic and comprehensive experience for attendees to network, explore business opportunities and engage in knowledge-sharing to chart the future direction for business aviation.

Asia Pacific – Solid Market Fundamentals with a Second Boom in the Making

The Asia-Pacific (APAC) business aviation market has demonstrated resilience and outperformed global growth in recent years. During the press conference held on March 4, Leck Chet Lam, Managing Director of show organizer Experia Events, highlighted “five key indicators” that provided confidence to step into the gap and create a global event dedicated to business aviation amid a thriving regional landscape.

First, the market sentiment has been positive. IMF data shows the APAC region maintaining consistent growth rate close to 5%, with emerging economies such as Cambodia, India, Vietnam and Indonesia serving as potential hotspots of growth over the next decade. With business recovery and renewed investment inflow, corporate travel has also seen its first rebound since COVID-19, with more “time-poor” individuals driving the renewed intent to purchase business jets.

Second, the fleet size in APAC is forecasted to grow faster than the global average, despite the region currently being the third largest market for business aviation. The Aviation Week Intelligence Network projects a compound annual growth rate (CAGR) of 2.1% for the next 10 years, compared to the global average of 1.4%.

Looking deeper within the region, interesting market shifts can be seen with the emergence of new havens. While the Asian Sky Group’s Business Jet Fleet Report for 2024 records Mainland China as retaining the largest share with 249 business jets, it also experienced a net decrease of 21 jets. Conversely, India emerged as a fast-growing market, adding 16 aircraft in 2024, reflecting a growth rate of 9.5%. Meanwhile, Southeast Asia led net fleet growth by sub-region, with a net addition of 17 aircraft, marking a 6.2% increase compared to the previous year. Singapore saw a net addition of 11 aircraft, of which nine were relocated from elsewhere in APEC, signalling rising demand for private jet services locally.

Third, the Maintenance, Repair, Overhaul (MRO) sector is also experiencing healthy growth. The Aviation Week Intelligence Network forecasts a 4.1% CAGR from 2025 to 2034, compared to the global average of 3.2%. Strong type preference for new and pre-owned aircraft further contributes to opportunities for MRO providers, engine and parts suppliers, crew training and ancillary services.

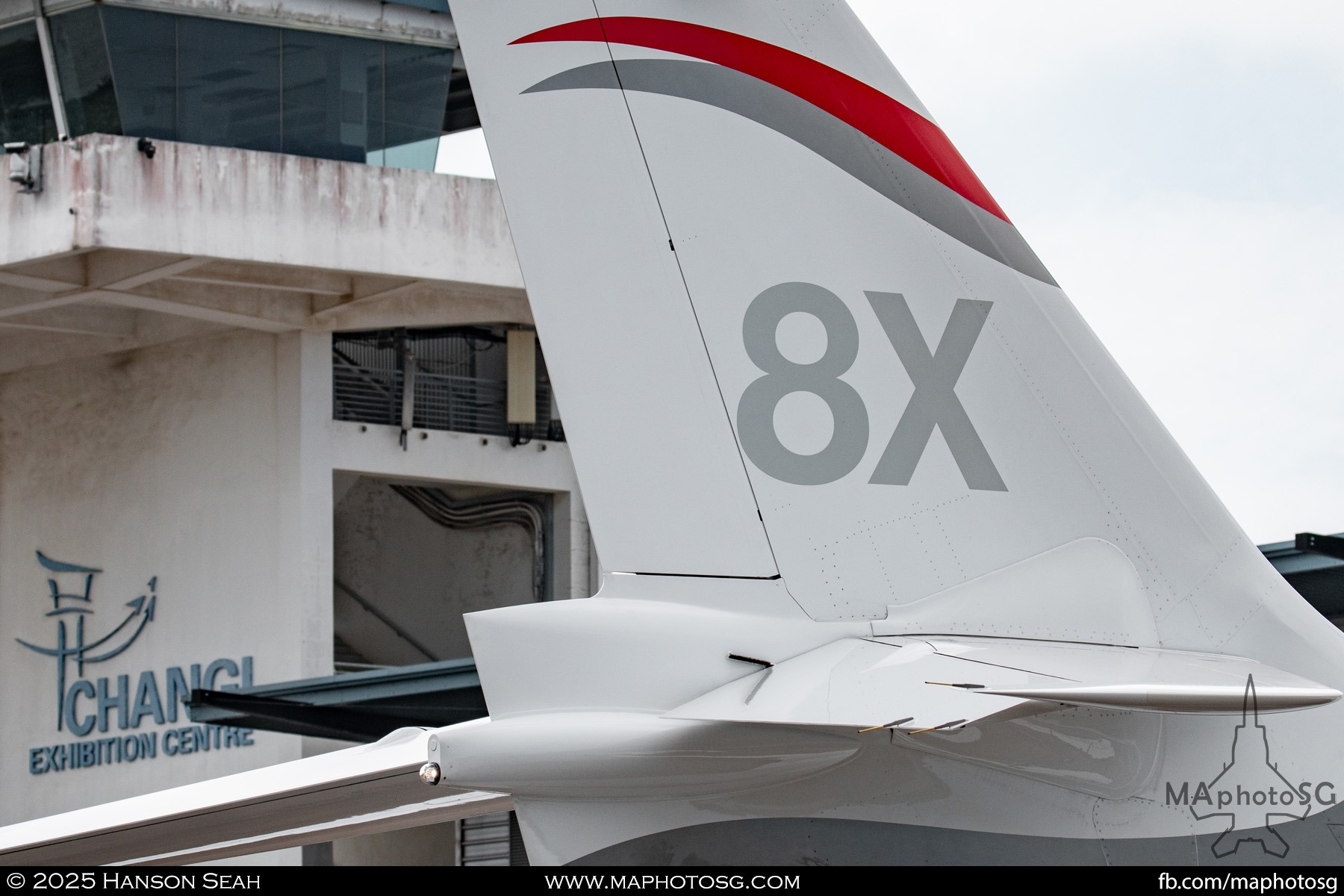

Data from Asian Sky Group’s Business Jet Fleet Report indicates Gulfstream and Bombardier remained the top OEMs in APEC, collectively contributing to USD 1,506.6 million, or 85.6% of the total delivery value into the region in 2024. Notably, models such as the Gulfstream G650ER and Bombardier Global 7500 have been particularly popular for new deliveries, catering to the intercontinental travel needs of ultra-high-net-worth (UNHW) individuals. The Pilatus PC-24 also saw renewed interest due to improvements in range, payload capacity, and cabin interiors, making it suitable for regional, short-distance flights. Meanwhile, the Gulfstream G550 remained the top choice for pre-owned additions.

Fourth, flying hours have surpassed pre-COVID levels, with a 41% increase compared to 2019, according to the Aviation Week Intelligence Network. This surge underscores the need for operational efficiency. To maximise aircraft utilisation, corporate operators have been reassessing their fleet composition to align with regional demand for long-range and ultra-long range travel. Offshore registry growth also indicates positioning for greater flexibility in long-range operations, with San Marino (T7-) leading the surge, according to Asian Sky Group’s Business Jet Fleet Report. Meanwhile, United States (N) registrations continue to be beneficial for these operations.

Fifth, the rise of UHNW individuals represents a shift in business aviation clientele from corporate to luxury travel. A report by Altrata predicts that by 2027, nearly one-third of the world’s UNHW population—defined as those with a net worth of at least $30 million—will be based in APAC.

With strong market fundamentals, APAC’s business aviation sector is primed for growth. BAAFEx serves as a key platform for operators, manufacturers, and service providers to capitalize on emerging opportunities and drive the industry forward.

Carrying the Momentum Forward

BAAFEx 2025 generated substantial buzz in it’s debut edition, attributed to to the show’s diverse representation and Singapore’s strategic location for the APAC market.

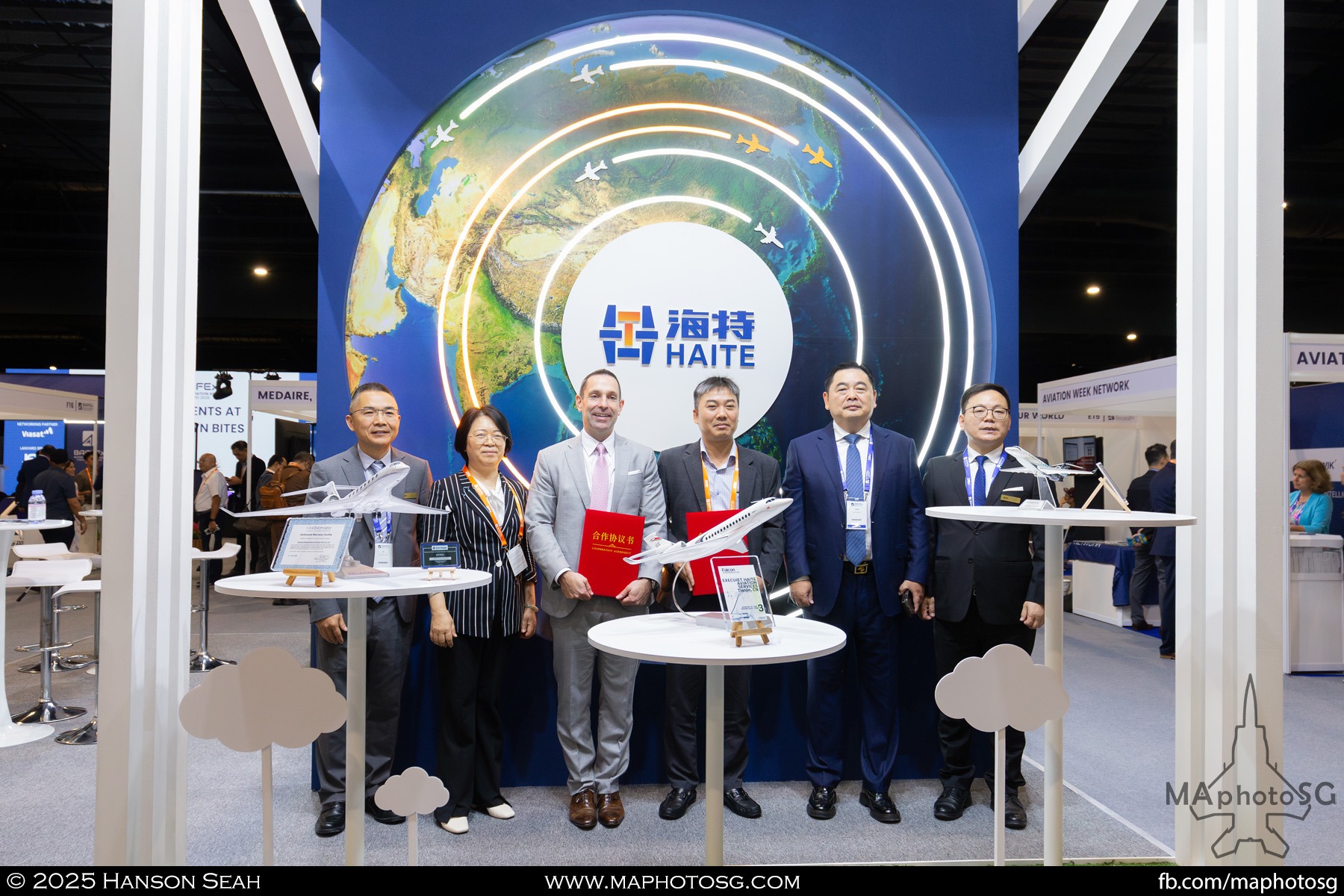

Exhibitors covered a wide spectrum of business aviation offerings, including OEMs, MROs, FBOs (Fixed-Base Operators), regulators, inflight connectivity providers, cabin interiors specialists, SATCOM providers, all eager to expand their presence in the industry.

Conference sessions explored various topics, including market trends, technological advancements, and regulatory developments in business aviation. The near-full capacity attendance of these sessions underscored the strong interest and engagement from industry professionals.

“The consensus among exhibitors, sponsors and trade visitors is that the inaugural show exceeded their expectations,” said Leck.

Regarding Singapore as the ideal location for BAAFEx, Leck emphasized the country’s strategic advantages: “Singapore’s central location allows connectivity to every corner of APAC within six to eight hours,” and is reputed to be a “neutral and business-friendly environment.”

He further highlighted Singapore’s extensive aviation ecosystem: “From a custom-built exhibition site for aviation events at CEC to a well-established aviation hub in Seletar, multiple MRO facilities, and strong financing and legal services, Singapore offers a world-class, one-stop solution for business aviation.”

The overwhelming success of BAAFEx 2025 has set a high benchmark for future editions. With multiple indications pointing to an outperforming APAC business aviation market, the region’s significance is only beginning to take centre stage. There is optimism and anticipation for an even larger event in 2027, building on the “enormous momentum” generated from the debut edition. BAAFEx 2027 is scheduled to be held from April 4 to 6, 2027, at Changi Exhibition Centre, Singapore.

Photo Gallery